Use the following information for questions

Pierre's Pet Shop Limited bought new grooming equipment on January 1, 2012 for $13,000. The useful life is estimated to be 3 years with a residual value of $1,000. The company uses straight-line depreciation. On January 1, 2013, Pierre determined that the value of the equipment is impaired, as its recoverable amount is expected to be $4,800.

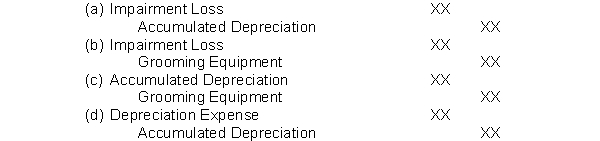

-The journal entry to record the impairment would involve debits and credits to the following accounts:

Definitions:

Balance Sheet Debit

An entry on the left side of a balance sheet, typically indicating an increase in assets or a decrease in liabilities or equity.

Net Income

Profits after subtracting all costs, including operating expenses, interest, and taxes, from total revenue, indicating the final earning outcome of a business.

Adjusted Trial Balance

A financial report that lists all the account titles and balances of a company after adjusting entries are made, used for the preparation of financial statements.

Unadjusted Trial Balance

A preliminary report in accounting that lists all the balances from all the accounts before any end-of-period adjustments are made.

Q8: With fixed principal payments on a long-term

Q18: Consolidated financial statements are appropriate when an

Q20: Under the perpetual inventory system, purchases of

Q22: Inventory that originally cost $10,000 was written

Q68: Island Corporation gathered the following reconciling information

Q73: Approximating the physical flow of inventory is

Q93: A truck costing $32,000 was destroyed when

Q94: Trading investments are always classified as current

Q127: Stock Dividends Distributable is reported as a

Q139: The term residual claim refers to a