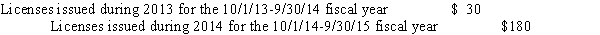

A city with a 12/31 fiscal year-end requires that restaurants buy a license, renewable yearly.Proceeds of the license fees are intended to pay the salaries of inspectors in the health department.Licenses are issued for a fiscal year from October 1 to September 30.During 2014, cash collections related to licenses were as follows  It is anticipated that during 2015 the amount collected on licenses for the 10/1/14-9/30/15 fiscal year will be $45.In September 2013 the amount collected related to 10/1/13-9/30/14 licenses was $144.What amount should be recognized as revenue in the fund financial statements for the fiscal year ended 12/31/14?

It is anticipated that during 2015 the amount collected on licenses for the 10/1/14-9/30/15 fiscal year will be $45.In September 2013 the amount collected related to 10/1/13-9/30/14 licenses was $144.What amount should be recognized as revenue in the fund financial statements for the fiscal year ended 12/31/14?

Definitions:

Unfit to Stand Trial

A legal determination that a person is not mentally capable of participating in their defense due to mental illness or incapacity.

Echolalia

The automatic and involuntary repetition of words or phrases spoken by others, often observed in autism and certain neurological conditions.

Autistic Spectrum Disorder

A range of neurodevelopmental conditions characterized by challenges with social skills, repetitive behaviors, and speech and nonverbal communication.

Delusional Disorder

A mental disorder characterized by the presence of delusions, which are fixed false beliefs that contradict reality, without the presence of other major psychiatric symptoms.

Q2: Generally accepted accounting principles require governments to

Q10: The city created a legally separate port

Q25: A U.S.corporation may not claim, as a

Q28: The entry in the capital projects fund

Q33: Which of the following is likely to

Q35: Taxpayer T would like to "shift" some

Q38: A U.S.corporation established a 100 percent

Q39: In accounting for operating leases, the rental

Q41: Which of the following is not deductible

Q51: The city of Maine Creek acquired a