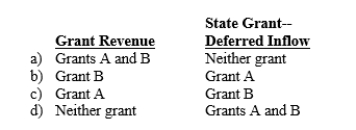

Paul City received payment of two grants from the state during its fiscal year ending September 30, 2013.Grant A can be used to cover any operating expenses incurred during fiscal 2014.Grant B can be used at any time to acquire equipment for the city's fire department.Should the city report these grants as grant revenues or deferred inflows in its governmental fund financial statements for fiscal 2013?

Definitions:

Access Right

The privilege or ability to enter, retrieve, or make use of data or facilities.

Ethical Decision-Making Model

A structured approach to ensure decisions are made in a morally and ethically sound manner, considering all stakeholders involved.

Autonomy

The capacity to make an informed, uncoerced decision; in ethical and political philosophy, autonomy is often considered a fundamental right.

Beneficence

This is the ethical principle that guides actions aimed at doing good or benefiting others, commonly referenced in healthcare and research ethics.

Q9: In the current taxable year, trust beneficiary

Q16: Passive income, such as interest, dividends, rents,

Q17: As a general rule, tax provisions that

Q19: W, a single taxpayer, made her first

Q21: A family member will be recognized as

Q24: What is the date of the statute

Q32: During the current year, the Estate of

Q35: Dale City Light & Water (a proprietary

Q39: GASB standards allow a major exception for

Q53: During 2014, a state has the following