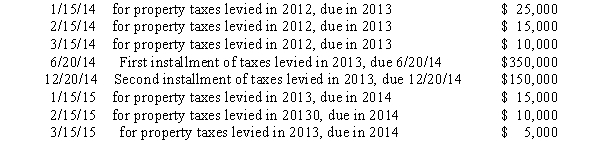

A city that has a 12/31 fiscal year end has adopted a policy of recognizing property tax revenue consistent with the 60-day rule allowable period under GAAP.Property taxes of $600,000 (of which none are estimated to be uncollectible) are levied in October 2013 to finance the activities of fiscal year 2014.Property taxes are due in two installments June 20 and December 20.Cash collections related to property taxes are as follows:  The total amount of property tax revenue that should be recognized in the governmental fund financial statements in 2014 is:

The total amount of property tax revenue that should be recognized in the governmental fund financial statements in 2014 is:

Definitions:

Social Harmony

A state of peaceful coexistence and mutual understanding within a society or group.

Vibrant Plumage

Refers to bright and colorful feathers of birds, often used for attraction or signaling within species.

Sexual Selection

A form of natural selection where individuals with certain inherited characteristics are more likely than others to obtain mates, influencing evolution.

Male Dominance

A social construct where men hold primary power and predominate in roles of political leadership, moral authority, social privilege, and control of property.

Q4: Funds divide a government into functional departments.

Q6: During the current fiscal year, Mountain View

Q10: Prior to the issuance of GASB Statement

Q11: Several years ago, Grant County was sued

Q27: The accounting cycle for most governments is

Q32: A U.S.-based multinational parent corporation owns 75

Q34: Which of the following constituency groups would

Q42: For Federal gift tax purposes, when a

Q60: There are only two government-wide statements: the

Q67: The State University Foundation is a legally