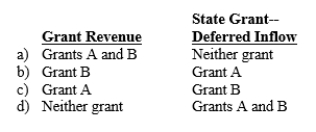

Paul City received payment of two grants from the state during its fiscal year ending September 30, 2013.Grant A can be used to cover any operating expenses incurred during fiscal 2014.Grant B can be used at any time to acquire equipment for the city's fire department.Should the city report these grants as grant revenues or deferred inflows in its government-wide financial statements for fiscal 2013?

Definitions:

Doctrine

A set of beliefs, policy, or position, often held by organizations, governments, or religious groups.

Prospectus

An official document issued by companies that are offering securities for sale to the public, detailing the investment’s objectives, risks, and financial statements.

Securities

Financial instruments that represent an ownership position, a creditor relationship, or rights to ownership, such as stocks, bonds, and options.

Conflict of Interest

A situation in which an individual's personal interests could potentially influence or appear to influence their professional judgment or responsibilities.

Q1: A U.S.corporation established a 100 percent

Q1: The general period of limitations for tax

Q2: Which of the following statements is false

Q3: T, a U.S.citizen who has been

Q11: Governments do not have to depreciate infrastructure

Q12: In 1980, T bought 100 shares of

Q17: P, a single taxpayer, meets the bona

Q39: Theta Partnership, a calendar year taxpayer, operates

Q39: Most states allow an exclusion for interest

Q42: Which of the following characteristics distinguishes a