Essay

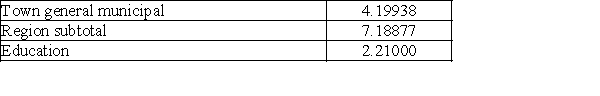

Paul is a homeowner in Whitby and his home value has been recently assessed by MPAC as $339 500. Paul's tax notice lists the following mill rates for various local services and capital developments. Calculate current year's total property tax.

Definitions:

Related Questions

Q3: A salesperson earned a commission of $926.59

Q5: What is the accumulated value of deposits

Q7: Convert this fraction into the decimal form.

Q14: At the conclusion of the audit, auditors

Q20: Doris purchased a piano with $1300.00 down

Q24: Your full-time job pays you a bi-weekly

Q29: An emphasis of matter paragraph is mandatory

Q35: At the conclusion of the audit, _.<br>A)auditors

Q50: Comparing financial statement presentation with Generally Accepted

Q73: At what nominal rate of interest compounded