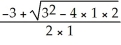

Simplify:

Definitions:

Product Cost

The total amount of costs directly and indirectly involved in manufacturing a product or delivering a service.

Variable Costing

A costing method that includes only variable manufacturing costs—direct materials, direct labor, and variable manufacturing overhead—in unit product costs.

Super-Variable Costing

A costing method that classifies all direct labor and manufacturing overhead costs as fixed period costs and only direct materials as a variable product cost.

Variable Costing

An accounting method that only assigns variable costs to inventory, treating fixed costs as period expenses.

Q3: A salesperson earned a commission of $926.59

Q5: What is the accumulated value of deposits

Q9: Compute the nominal annual rate of interest

Q10: In how many days will $770.00 grow

Q15: Sarah receives a semi-monthly salary of $933.20

Q52: The Financial Accounting Standards Board (FASB) defines

Q54: The city of Toronto had a property

Q83: If more than one component auditor was

Q106: If management determines the loss contingency is

Q146: Data controls over payroll processing relate to