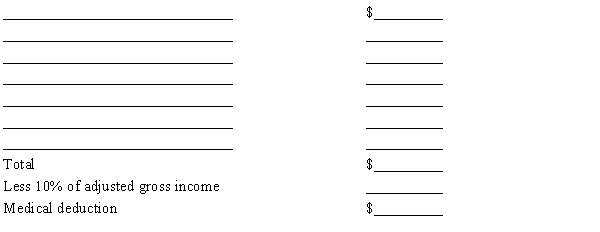

For 2019, Betsy and Bob, ages 62 and 68, respectively, are married taxpayers who file a joint tax return with AGI of $50,000. During the year they incurred the following expenses: In addition, their insurance company reimbursed them $3,100 for the above expenses.

?

Using the format below, calculate Betsy and Bob's deduction for medical and dental expenses for 2019.  ?

?

Definitions:

Local Labor Market

The supply and demand for workers within a specific region or area, affecting employment and wages.

Host Country

The country in which a multinational company operates a facility, as opposed to the country where the company is headquartered.

Qualified People

Individuals who meet the necessary standards and qualifications for a job, project, or activity, based on their skills, experiences, and education.

Extroverted

A personality trait characterized by being outgoing, sociable, and energized by interactions with others.

Q5: Amounts received by an employee as reimbursement

Q14: Moe has a law practice and

Q17: Which of the following types of interest

Q29: The payout to an employee in a

Q30: In 2019, all taxpayers may make a

Q50: Which of the following is not considered

Q78: Unreimbursed qualifying moving expenses are an itemized

Q89: Susie received unemployment benefits in the current

Q101: Eugene and Velma are married. For 2019,

Q115: Which of the following is not deductible