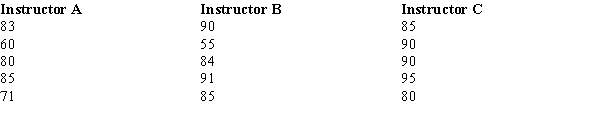

The test scores for selected samples of sociology students who took the course from three different instructors are shown below.

At α = .05, test to see if there is a significant difference among the averages of the three groups.Use both the critical value and p-value approaches.

Definitions:

Expected Rate

In finance, it typically refers to the predicted average rate of return on an investment over a specified period.

Standard Deviation

A statistical measure that quantifies the amount of variability or dispersion of a set of data values around the mean (average).

Risk-Free Asset

A financial instrument that is considered to have no risk of financial loss and typically features a guaranteed rate of return, such as government bonds.

Standard Deviation

A measure of the amount of variation or dispersion in a set of values, showing how much each value in the set differs from the mean.

Q25: For a given confidence level and when

Q30: Which of the following statements is CORRECT?<br>A)

Q53: In 2002, 40% of the students at

Q57: Analysts following Armstrong Products recently noted that

Q60: In a multiple regression model involving 44

Q76: The following information was obtained from matched

Q80: The manager of the service department of

Q98: A random sample of 81 SAT scores

Q114: In order to determine an interval for

Q133: The z value for a 97.8% confidence