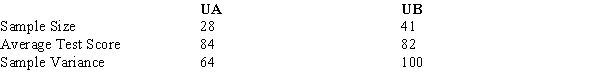

Test scores on a standardized test from samples of students from two universities are given below.

Provide a 98% confidence interval estimate for the difference between the mean test scores of the two universities.

Definitions:

Financial Intermediaries

Institutions such as banks, mortgage companies, and finance companies, that serve as go-betweens, borrowing from people who have saved to make loans to others.

Capital

Wealth in the form of money or assets, invested in order to start a business or invest in order to generate more wealth.

Real GDP

Gross domestic product adjusted for changes in the price level, providing a more accurate picture of an economy's size and growth.

Consumption

the process by which goods and services are used up by individuals or groups, typically considered the end-use in economic production cycles.

Q23: What is the probability that x is

Q25: Read the z statistic from the normal

Q35: A random sample of 100,000 credit sales

Q54: A group of 2000 individuals from 3

Q55: The business manager of a local health

Q71: A regression model involving 4 independent variables

Q73: The value of the coefficient of correlation

Q83: Two major automobile manufacturers have produced compact

Q94: In a local university, 70% of the

Q101: A population has a mean of 400