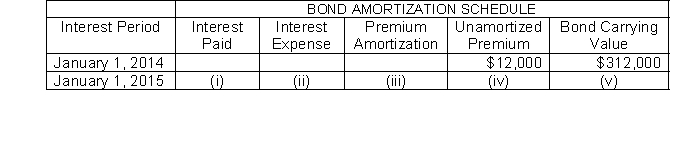

218. Presented here is a partial amortization schedule for Roseland Company who sold $300,000, five year 10% bonds on January 1, 2014 for $312,000 and uses annual straight-line amortization.  Which of the following amounts should be shown in cell (i) ?

Which of the following amounts should be shown in cell (i) ?

Definitions:

Discount Factor(s)

A multiplier for determining the present value of future cash flows or other investments, reflecting the time value of money.

Simple Rate Of Return

A method to calculate the profitability of an investment by dividing the annual incremental net operating income by the initial investment cost.

Straight-Line Depreciation

A method of calculating the depreciation of an asset by evenly spreading its cost over its useful life.

Salvage Value

The estimated resale value of an asset at the end of its useful life, taken into consideration for depreciation calculations.

Q6: The market value (present value) of a

Q18: Notes receivable represent claims for which formal

Q30: The following selected amounts are available for

Q50: Yocum Company purchased equipment on January 1

Q64: If bonds can be converted into common

Q105: Deborah Company's account balances at December 31

Q135: Treasury stock is generally accounted for by

Q159: In a recent year Joey Corporation had

Q177: The sale of common stock below par<br>A)is

Q195: The paneling of the body of an