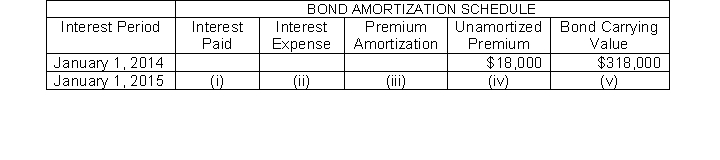

Presented here is a partial amortization schedule for Roseland Company who sold $300,000, five year 10% bonds on January 1, 2014 for $318,000 and uses annual straight-line amortization.  Which of the following amounts should be shown in cell (iv) ?

Which of the following amounts should be shown in cell (iv) ?

Definitions:

Materials Handling

The movement, protection, storage, and control of materials and products throughout manufacturing, warehousing, distribution, consumption, and disposal.

Cost Per Unit

The calculation of the cost to produce or acquire a single unit of product, including direct materials, labor, and overhead.

Selling and Administrative Cost

Expenses related to the selling of products and the general administration of a business, not including production costs.

Activity Rate

A measurement used in activity-based costing to allocate costs to specific activities, typically expressed as a cost per activity unit.

Q12: Under the corporate form of business organization<br>A)a

Q29: The term "receivables" refers to<br>A)amounts due from

Q33: Jack Company provides for bad debt expense

Q53: The retained earnings statement<br>A)is the owners' equity

Q54: Under the direct write-off method, no attempt

Q62: The account Allowance for Doubtful Accounts is

Q67: A 60-day note receivable dated July 13

Q88: Notes or accounts receivables that result from

Q196: Goodwill is not recognized in accounting unless

Q213: A loss on disposal of a plant