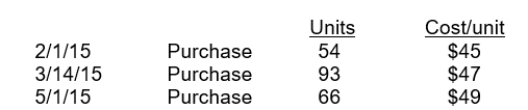

Romanoff Industries had the following inventory transactions occur during 2015:  The company sold 150 units at $70 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using FIFO? (rounded to whole dollars)

The company sold 150 units at $70 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using FIFO? (rounded to whole dollars)

Definitions:

Q3: The terms 2/10, n/30 state that a

Q16: Two methods of accounting for uncollectible accounts

Q27: Cash equivalents are highly liquid investments that

Q44: The account, Supplies, will appear in the

Q46: During August, 2015, Baxter's Supply Store generated

Q47: Under the direct write-off method of accounting

Q83: Bacher Company developed the following reconciling information

Q83: The specific identification method of inventory valuation

Q153: The balances that appear on the post-closing

Q160: The first item listed under current liabilities