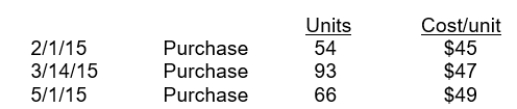

Romanoff Industries had the following inventory transactions occur during 2015:  The company sold 150 units at $70 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using LIFO? (rounded to whole dollars)

The company sold 150 units at $70 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using LIFO? (rounded to whole dollars)

Definitions:

Dram Shop Acts

Laws in several U.S. states that impose liability on establishments serving alcoholic drinks to intoxicated persons or minors who subsequently cause harm to others.

Bartenders

Individuals who mix and serve alcoholic beverages and other drinks to customers in bars, clubs, or similar establishments.

Bar Owners

Individuals or entities that own establishments serving alcoholic beverages to the public.

Seeking Damages

The legal process of requesting compensation for losses or harm suffered.

Q11: Under the lower-of-cost-or-market basis in valuing inventory,

Q25: Freight terms of FOB Destination means that

Q28: GAAP, compared to IFRS, tends to be

Q75: Checks from customers who pay their accounts

Q84: A merchandising company has different types of

Q107: A bank statement<br>A)lets a depositor know the

Q131: To obtain maximum benefit from a bank

Q137: On November 1, Gentle Company received a

Q149: Trade receivables occur when two companies trade

Q149: A perpetual inventory system would likely be