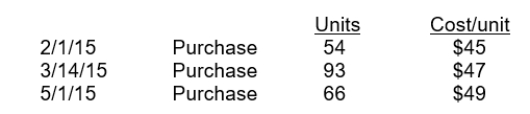

Romanoff Industries had the following inventory transactions occur during 2015:  The company sold 150 units at $70 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's gross profit using FIFO? (rounded to whole dollars)

The company sold 150 units at $70 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's gross profit using FIFO? (rounded to whole dollars)

Definitions:

Fixed Expenses

are costs that do not change with the volume of production or sales, such as rent and salaries.

Sales

The transactions between a company and its customers where goods or services are provided in exchange for money.

Margin of Safety

The difference between actual sales and breakeven sales, indicating how much sales can decrease before a business incurs a loss.

Variable Expenses

Expenditures that fluctuate in tandem with operational activity levels, including costs like utilities and commissions.

Q12: The method most commonly used to compute

Q33: Under generally accepted accounting principles, management has

Q49: A note is dishonored when it is

Q58: The retail inventory method requires a company

Q71: The following information is available for Everett

Q88: Adjusting entries are not necessary if the

Q103: Netta Shutters has the following inventory information.

Q117: On a classified balance sheet, current assets

Q128: The use of fair value to report

Q139: If companies have identical inventoriable costs but