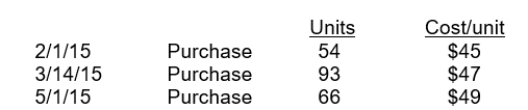

Romanoff Industries had the following inventory transactions occur during 2015:  The company sold 150 units at $70 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using FIFO? (rounded to whole dollars)

The company sold 150 units at $70 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using FIFO? (rounded to whole dollars)

Definitions:

Valuable Consideration

Any benefit, right, or interest that has tangible or intangible worth, which is provided by one party to another as part of a contract.

Reasonable Value

An estimated worth based on what is fair and sensible, considering the circumstances and context.

Necessaries

Items or services that are considered essential for maintaining a reasonable standard of living, such as food, clothing, and shelter.

Emancipation

The legal process through which a minor becomes self-supporting and assumes adult responsibility for their welfare.

Q23: Accounts often need to be adjusted because<br>A)there

Q26: In recording the acquisition cost of an

Q35: A company stamps checks received in the

Q39: The following items are taken from the

Q60: If the month-end bank statement shows a

Q91: The accountant at Cedric Company has determined

Q105: The asset turnover is computed by dividing<br>A)net

Q139: IFRS requires the use of<br>A)the term balance

Q142: The collection of a $1,000 account after

Q179: The factor that is not relevant in