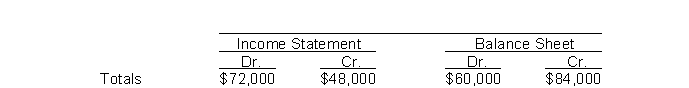

The income statement and balance sheet columns of Iron and Wine Company's worksheet reflect the following totals:  To enter the net income (or loss) for the period into the above worksheet requires an entry to the

To enter the net income (or loss) for the period into the above worksheet requires an entry to the

Definitions:

Social Security Tax

A payroll tax collected by governments to fund social security programs, typically a percentage of an employee's salary.

Medicare Tax

Medicare Tax is a federal payroll tax used to fund the Medicare program, which provides health insurance for eligible elderly and disabled individuals.

Social Security Tax

Social Security Tax is a tax levied on both employers and employees to fund the Social Security program, which provides retirement, disability, and survivorship benefits.

Medicare Tax

A federal tax deducted from an individual’s earnings to fund the Medicare program, typically as part of payroll taxes.

Q59: Financial information is presented below: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6276/.jpg"

Q72: Sales revenue less cost of goods sold

Q90: Gain on sale of equipment and interest

Q95: Dreamtime Laundry purchased $7,000 worth of supplies

Q96: Operating expenses are different for merchandising and

Q122: Company X sells $900 of merchandise on

Q130: The name given to entering transaction data

Q131: A candy factory's employees work overtime to

Q146: In one closing entry, Dividends is credited

Q183: An adjusting entry<br>A)affects two balance sheet accounts.<br>B)affects