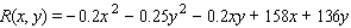

The total weekly revenue (in dollars) of the company realized in manufacturing and selling its rolltop desks is given by  where x denotes the number of finished units and y denotes the number of unfinished units manufactured and sold each week.The total weekly cost attributable to the manufacture of these desks is given by

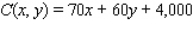

where x denotes the number of finished units and y denotes the number of unfinished units manufactured and sold each week.The total weekly cost attributable to the manufacture of these desks is given by  dollars.Determine how many finished units and how many unfinished units the company should manufacture each week in order to maximize its profit.What is the maximum profit(P) realizable?

dollars.Determine how many finished units and how many unfinished units the company should manufacture each week in order to maximize its profit.What is the maximum profit(P) realizable?

x = __________

y = __________

P = $__________

Definitions:

Face Value

The nominal or stated value of a security or financial instrument, such as a bond, note, or coin.

Taxable Income

Earnings that are taxable.

Medicare Tax

The amount of Medicare tax an employee pays is a set percentage of the entire income with no maximum amounts; the amount paid is split between the employee and employer.

FICA Taxes

Taxes funded by both employers and employees to finance Social Security and Medicare benefits, based on earned income.

Q7: The number of Americans aged 45 to

Q17: Modern revenue management systems maximize revenue potential

Q18: An objective function reflects the relevant cost

Q21: Minimize the function <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7866/.jpg" alt="Minimize the

Q24: To use Excel to generate a normally

Q49: Find the area of the region under

Q102: Evaluate the definite integral. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7866/.jpg" alt="Evaluate

Q173: Evaluate the following improper integral whenever it

Q180: The quantity demanded x (in thousands of

Q221: At a certain point, a river is