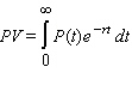

The present value of a perpetual stream of income that flows continually at the rate of  dollars per year is given by the formula

dollars per year is given by the formula  where

where  is the interest rate compounded continuously.Using this formula, find the present value of a perpetual net income stream that is generated at the rate of

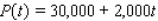

is the interest rate compounded continuously.Using this formula, find the present value of a perpetual net income stream that is generated at the rate of  dollars per year.

dollars per year.

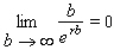

Hint:  .

.

Definitions:

Q6: Because the dual price represents the improvement

Q10: Production constraints frequently take the form:<br>beginning inventory

Q16: In a multicriteria decision problem<br>A)it is impossible

Q26: Because surplus variables represent the amount by

Q28: Figure (a) shows a vacant lot with

Q95: The demand function for a certain brand

Q172: Find an approximation of the area of

Q206: Find the indefinite integral. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7866/.jpg" alt="Find

Q298: Find the average value of the function

Q304: Estimate the present value of an annuity