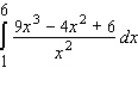

Evaluate the definite integral.

Definitions:

Augmented Reality

Augmented reality is a technology that overlays digital information, such as images or sounds, onto the physical world, enhancing one's perception of reality.

Virtual Reality

A computer-generated simulation of a three-dimensional environment that can be interacted with in a seemingly real or physical way through the use of special electronic equipment.

Microprocessor

The CPU, made up of millions of transistors embedded in a circuit on a silicon wafer or chip.

Control Unit

Portion of the CPU that controls the flow of information.

Q15: The total daily revenue (in dollars) that

Q57: The following data, compiled by the superintendent

Q75: Find the area of the region under

Q123: Approximate the value of the definite integral.

Q132: In a study conducted by a certain

Q160: Determine whether the statement is true or

Q188: Evaluate the following improper integral whenever it

Q205: A formula used by meteorologists to calculate

Q213: Simplify the expression. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7866/.jpg" alt="Simplify the

Q247: Use the formula <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7866/.jpg" alt="Use the