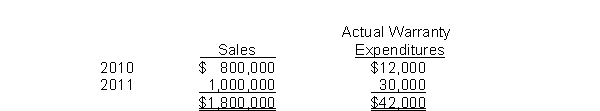

During 2010, Eaton Co.introduced a new product carrying a two-year warranty against defects.The estimated warranty costs related to dollar sales are 2% within 12 months following sale and 4% in the second 12 months following sale.Sales and actual warranty expenditures for the years ended December 31, 2010 and 2011 are as follows:  At December 31, 2011, Eaton should report an estimated warranty liability of

At December 31, 2011, Eaton should report an estimated warranty liability of

Definitions:

Income Statement

A financial document that shows a company's revenues, expenses, and net income over a specific period of time.

Fiscal Period

A specified period of time used for financial reporting and budgeting, typically a year, quarter, or month.

Biweekly Salaries

Payments made to employees every two weeks, totaling 26 payments throughout the year.

Unearned Revenue

Money received by a company for a product or service that has yet to be delivered or performed.

Q1: Farmer Company issues $10,000,000 of 10-year, 9%

Q6: U.S. firms could not make a profit

Q17: Assume a two-country, two-good, and two-input model.

Q20: After an impairment loss is recorded, the

Q33: In the figure given below AB is

Q37: The primary objective of the European Central

Q38: The table given below shows the

Q84: After an impairment loss is recorded for

Q119: Under International Financial Reporting Standards (IFRS), agricultural

Q125: Under current accounting practice, intangible assets are