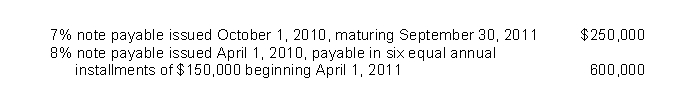

Included in Vernon Corp.'s liability account balances at December 31, 2010, were the following:  Vernon's December 31, 2010 financial statements were issued on March 31, 2011.On January 15, 2011, the entire $600,000 balance of the 8% note was refinanced by issuance of a long-term obligation payable in a lump sum.In addition, on March 10, 2011, Vernon consummated a noncancelable agreement with the lender to refinance the 7%, $250,000 note on a long-term basis, on readily determinable terms that have not yet been implemented.On the December 31, 2010 statement of financial position, the amount of the notes payable that Vernon should classify as short-term obligations is

Vernon's December 31, 2010 financial statements were issued on March 31, 2011.On January 15, 2011, the entire $600,000 balance of the 8% note was refinanced by issuance of a long-term obligation payable in a lump sum.In addition, on March 10, 2011, Vernon consummated a noncancelable agreement with the lender to refinance the 7%, $250,000 note on a long-term basis, on readily determinable terms that have not yet been implemented.On the December 31, 2010 statement of financial position, the amount of the notes payable that Vernon should classify as short-term obligations is

Definitions:

Commercial Interests

Commercial interests refer to the concerns, priorities, or objectives of businesses and entrepreneurs, particularly those related to making a profit and expanding market share.

Speaker of the House

The presiding officer of the United States House of Representatives, responsible for leading the House's legislative business and representing the body.

Congressional Enactments

Laws and regulations that have been formally approved and passed by both houses of Congress.

Federalists

Members of a political party or movement in the late 18th and early 19th centuries in the United States that supported a strong central government, the ratification of the U.S. Constitution, and an expansive interpretation of federal government powers.

Q2: What is the proper characterization of the

Q35: Which characteristic is not possessed by intangible

Q56: By mid-2014, the U.S. government had approved

Q58: Labor productivity refers to:<br>A)the number of units

Q61: Kleinschmidt Company purchased a depreciable asset for

Q64: Stevenson Company purchased a depreciable asset for

Q64: On January 1, 2010, Huff Co.sold $1,000,000

Q90: On February 1, 2010, Nelson Corporation purchased

Q91: Assets that qualify for interest cost capitalization

Q102: Which of the following would not be