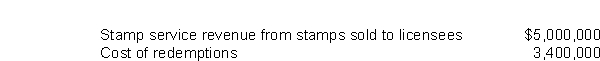

Yount Trading Stamp Co.records stamp service revenue and provides for the cost of redemptions in the year stamps are sold to licensees.Yount's past experience indicates that only 80% of the stamps sold to licensees will be redeemed.Yount's liability for stamp redemptions was $7,500,000 at December 31, 2010.Additional information for 2011 is as follows:  If all the stamps sold in 2011 were presented for redemption in 2011, the redemption cost would be $2,500,000.What amount should Yount report as a liability for stamp redemptions at December 31, 2011?

If all the stamps sold in 2011 were presented for redemption in 2011, the redemption cost would be $2,500,000.What amount should Yount report as a liability for stamp redemptions at December 31, 2011?

Definitions:

Watered Stock

Shares issued by a company at a value much greater than its asset worth, inflating its apparent value without actual backing.

Fair Market Value

An estimate of the market value of a property, based on what a knowledgeable, willing, and unpressured buyer would likely pay to a knowledgeable, willing, and unpressured seller in the market.

Business Judgment Rule

A legal principle protecting corporate directors and officers from liability for decisions made in good faith and in the best interest of the company.

Derivative Action

A lawsuit brought by a corporation’s shareholder on behalf of the corporation against a third party, often an insider of the corporation.

Q6: Assume the standard trade model with two

Q10: Explain how a mutually beneficial trade is

Q20: Which statement is true about the retail

Q34: The table given below shows the

Q41: Assets purchased on long-term credit contracts should

Q50: Suppose the domestic supply (Q<sup>S</sup>) and

Q80: On January 1, 2011, Chang Company sold

Q99: Under International Financial Reporting Standards (IFRS), when

Q108: On December 31, 2010, Irey Co.has $2,000,000

Q125: Under current accounting practice, intangible assets are