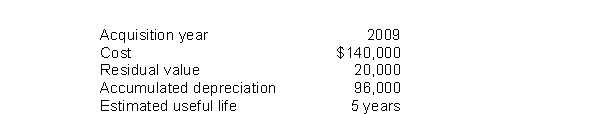

Hahn Co.takes a full year's depreciation expense in the year of an asset's acquisition and no depreciation expense in the year of disposition.Data relating to one of Hahn's depreciable assets at December 31, 2011 are as follows:  Using the same depreciation method as used in 2009, 2010, and 2011, how much depreciation expense should Hahn record in 2012 for this asset?

Using the same depreciation method as used in 2009, 2010, and 2011, how much depreciation expense should Hahn record in 2012 for this asset?

Definitions:

Financing Activities

Transactions with creditors or investors used to fund either company operations or expansions.

Investing Activities

Refers to the purchasing and selling of long-term assets and other investments, not including cash equivalents, which are reported in a company's cash flow statement.

Indirect Method

A cash flow statement approach that adjusts net income for the effects of non-cash transactions and changes in working capital to calculate cash from operating activities.

Accumulated Depreciation

The cumulative total of depreciation costs noted for an asset since it was acquired.

Q1: Farmer Company issues $10,000,000 of 10-year, 9%

Q32: The dollar-value LIFO method measures any increases

Q39: Bond interest expense reported on the December

Q47: Risers Inc.reported total assets of $1,600,000 and

Q50: A company issues $20,000,000, 7.8%, 20-year bonds

Q64: Stevenson Company purchased a depreciable asset for

Q84: After an impairment loss is recorded for

Q85: Agricultural produce is<br>A)Harvested from biological assets.<br>B)Valued at

Q111: Land was purchased to be used as

Q122: A company acquires a patent for a