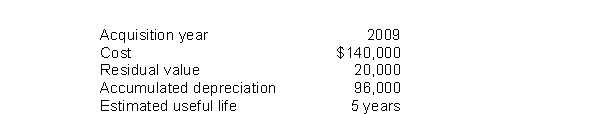

Hahn Co.takes a full year's depreciation expense in the year of an asset's acquisition and no depreciation expense in the year of disposition.Data relating to one of Hahn's depreciable assets at December 31, 2011 are as follows:  Using the same depreciation method as used in 2009, 2010, and 2011, how much depreciation expense should Hahn record in 2012 for this asset?

Using the same depreciation method as used in 2009, 2010, and 2011, how much depreciation expense should Hahn record in 2012 for this asset?

Definitions:

Partner's Equity

The interest or ownership a partner has in a partnership, representing their claim on the assets after liabilities are settled.

Owner's Equity

The residual interest in the assets of a company after deducting liabilities, representing the owner's claim on the company's resources.

Capital Account

An account showing the net worth of a business at a specific point in time, including the owner's investment and retained earnings.

Capital Balance

The amount of money or value of assets contributed by owners or partners to a business, reflecting their equity in the business.

Q5: On January 1, 2011, Lorry Manufacturing Company

Q7: In the gross method, sales discounts are

Q23: India Enterprises has four divisions.It acquired one

Q24: During 2010, Vanpelt Co.introduced a new line

Q50: A country cannot set its own policies

Q61: In 2010, Payton Corporation began selling a

Q61: What amount should Armstrong Co.record for the

Q66: Which of the following should not be

Q78: Amortization of the discount on a zero-interest

Q97: What is the effect of net markups