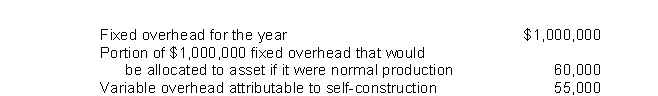

During self-construction of an asset by Richardson Company, the following were among the costs incurred:  What amount of overhead should be included in the cost of the self-constructed asset?

What amount of overhead should be included in the cost of the self-constructed asset?

Definitions:

Accounting Records

Documents and books that keep track of the financial operations and transactions of an entity or individual, serving as evidence of financial performance and position.

Computer

An electronic device capable of processing, storing, and retrieving data, used for a wide range of tasks from computing to entertainment.

Double-Entry Bookkeeping System

An accounting technique which records each transaction in two accounts, ensuring the total debits equal total credits.

Fully Integrated Ledger System

A fully integrated ledger system is an accounting system where all the different financial and accounting records are comprehensively interconnected and maintained within a single framework.

Q2: At the end of the fiscal year,

Q9: ELO Corporation purchased a patent for $90,000

Q20: Which statement is true about the retail

Q36: Lenny's Llamas purchased 1,500 llamas on January

Q59: Fanestil Corporation purchased a depreciable asset for

Q93: The International Accounting Standards Board believes that

Q97: The percentage-of-sales method results in a more

Q99: Which of the following is the proper

Q125: Under current accounting practice, intangible assets are

Q132: The cash account shows a balance of