Use the following information for questions.

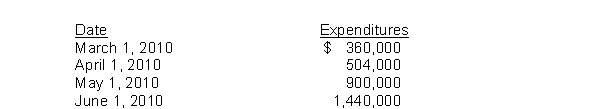

On March 1, 2010, Newton Company purchased land for an office site by paying $540,000 cash.Newton began construction on the office building on March 1.The following expenditures were incurred for construction:

The office was completed and ready for occupancy on July 1.To help pay for construction, $720,000 was borrowed on March 1, 2010 on a 9%, 3-year note payable.Other than the construction note, the only debt outstanding during 2010 was a $300,000, 12%, 6-year note payable dated January 1, 2010.

-Assume the weighted-average accumulated expenditures for the construction project are $870,000.The amount of interest cost to be capitalized during 2010 is

Definitions:

Creditors

Individuals or entities entitled to receive payment or repayment from a debtor, typically in relation to a financial loan or borrowings.

Food Safety Act

Legislation aimed at ensuring the safety and wholesomeness of food by setting down legal obligations regarding food handling, preparation, and storage.

Nutrition Information

Data provided about the nutritional content of food and beverages, including details on calories, fats, proteins, vitamins, minerals, and other significant nutrients.

Food Labels

Information printed on packaging that provides details about the nutritional content, ingredients, and other data related to food products.

Q7: If Lee chooses to account for the

Q9: On April 13, 2010, Neill Co.purchased machinery

Q26: Kesler, Inc.estimates the cost of its physical

Q46: Which of the following is a product

Q76: If an industrial firm uses the units-of-production

Q79: Short-term debt obligations are classified as current

Q92: Interest revenue earned on specific borrowings for

Q97: Which of the following is not an

Q106: Solar Products purchased a computer for $13,000

Q126: In a period of falling prices, which