Use the following information for questions.

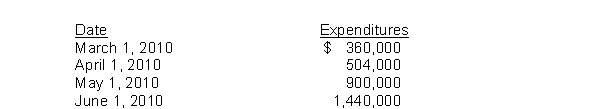

On March 1, 2010, Newton Company purchased land for an office site by paying $540,000 cash.Newton began construction on the office building on March 1.The following expenditures were incurred for construction:

The office was completed and ready for occupancy on July 1.To help pay for construction, $720,000 was borrowed on March 1, 2010 on a 9%, 3-year note payable.Other than the construction note, the only debt outstanding during 2010 was a $300,000, 12%, 6-year note payable dated January 1, 2010.

-During 2010, Bass Corporation constructed assets costing $1,000,000.The weighted-average accumulated expenditures on these assets during 2010 was $600,000.To help pay for construction, $440,000 was borrowed at 10% on January 1, 2010, and funds not needed for construction were temporarily invested in short-term securities, yielding $9,000 in interest revenue.Other than the construction funds borrowed, the only other debt outstanding during the year was a $500,000, 10-year, 9% note payable dated January 1, 2004.What is the amount of interest that should be capitalized by Bass during 2010?

Definitions:

Reduce Uncertainty

The action or practice of making a situation or outcome more predictable or less ambiguous.

Leasing

A contractual agreement where one party, the lessor, allows another party, the lessee, to use an asset for a specified period in exchange for periodic payments.

Temporary Basis

A condition or status applied for a limited time period, often used in finance to describe temporary adjustments or measures.

Assets

Resources owned or controlled by a business or an individual that are expected to produce economic value or benefit in the future.

Q11: The Accumulated Other Comprehensive Income account related

Q15: When the conventional retail method includes both

Q33: Cash equivalents are investments with original maturities

Q36: Peterson Company purchased machinery for $160,000 on

Q42: The present value of an ordinary annuity

Q61: Nichols Company had 400 units of "Dink"

Q69: Which of the following is not a

Q83: Bingham's 2012 income statement will report Loss

Q87: Contingent assets need not be disclosed in

Q93: Keen Company's accounting records indicated the following