Use the following information to answer questions

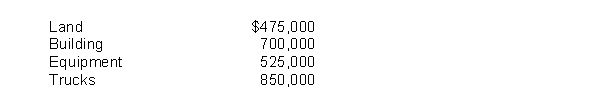

Jamison Company purchased the assets of Booker Company at an auction for $1,400,000.An independent appraisal of the fair value of the assets is listed below:

-On December 1, Miser Corporation exchanged 2,000 shares of its $25 par value ordinary shares held in treasury for a parcel of land to be held for a future plant site.The treasury shares were acquired by Miser at a cost of $40 per share, and on the exchange date the ordinary shares of Miser had a fair value of $50 per share.Miser received $6,000 for selling scrap when an existing building on the property was removed from the site.Based on these facts, the land should be capitalized at

Definitions:

Causal Attributions

The process by which individuals infer the causes of their own and others' behaviors, actions, and events.

Distinctiveness

The quality of being uniquely different from others in some respect, often used to describe features that distinguish one person, group, or thing from another.

Causal Hypothesis

A statement predicting a precise relationship between two or more variables, where changes in one variable cause changes in another.

Initial Causal Hypothesis

The original assumption or proposition about the cause-and-effect relationship between variables, awaiting testing or verification.

Q5: LIFO liquidation often distorts net income, but

Q7: January 2, 2008, Koll, Inc.purchased a patent

Q18: Hall Co.incurred research and development costs in

Q30: Renfro Corporation will invest $30,000 every December

Q80: Which of the following is a characteristic

Q93: Assuming that specific identification costs are impracticable

Q106: On August 1, 2010, Mendez Corporation purchased

Q118: Ferguson Company purchased a depreciable asset for

Q119: The company's 2012 income statement will report<br>A)Amortization

Q126: In a period of falling prices, which