Use the following information for questions.

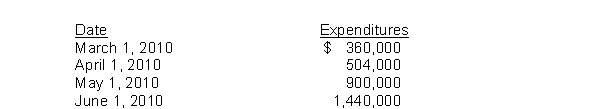

On March 1, 2010, Newton Company purchased land for an office site by paying $540,000 cash.Newton began construction on the office building on March 1.The following expenditures were incurred for construction:

The office was completed and ready for occupancy on July 1.To help pay for construction, $720,000 was borrowed on March 1, 2010 on a 9%, 3-year note payable.Other than the construction note, the only debt outstanding during 2010 was a $300,000, 12%, 6-year note payable dated January 1, 2010.

-Assume the weighted-average accumulated expenditures for the construction project are $870,000.The amount of interest cost to be capitalized during 2010 is

Definitions:

Fair Value Method

An accounting approach that measures and reports assets and liabilities on the basis of their estimated or actual fair market price.

Carrying Value

The book value of assets and liabilities on a company's balance sheet, excluding market value fluctuations.

Common Stock

Equity securities representing ownership in a corporation, with voting rights and potential dividends.

Par

The face value of a bond or stock, which is the amount the issuer agrees to pay at maturity in the case of a bond, or the value assigned to a share of stock at the time of issue.

Q11: Which of the following is considered research

Q21: If $3,000 is put in a savings

Q25: The International Accounting Standards Board has indicated

Q32: Durler Company traded machinery with a book

Q52: When funds are borrowed to pay for

Q71: Dicer uses the conventional retail method to

Q90: On February 1, 2010, Nelson Corporation purchased

Q106: On August 1, 2010, Mendez Corporation purchased

Q110: When an asset acquired through a government

Q128: A Cash Over and Short account<br>A)is not