Use the following information for questions.

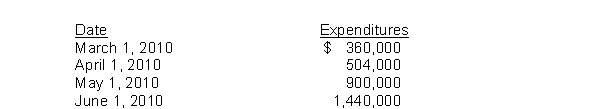

On March 1, 2010, Newton Company purchased land for an office site by paying $540,000 cash.Newton began construction on the office building on March 1.The following expenditures were incurred for construction:

The office was completed and ready for occupancy on July 1.To help pay for construction, $720,000 was borrowed on March 1, 2010 on a 9%, 3-year note payable.Other than the construction note, the only debt outstanding during 2010 was a $300,000, 12%, 6-year note payable dated January 1, 2010.

-During 2010, Bass Corporation constructed assets costing $1,000,000.The weighted-average accumulated expenditures on these assets during 2010 was $600,000.To help pay for construction, $440,000 was borrowed at 10% on January 1, 2010, and funds not needed for construction were temporarily invested in short-term securities, yielding $9,000 in interest revenue.Other than the construction funds borrowed, the only other debt outstanding during the year was a $500,000, 10-year, 9% note payable dated January 1, 2004.What is the amount of interest that should be capitalized by Bass during 2010?

Definitions:

Autism Spectrum Disorder

A developmental disorder characterized by difficulties in social interaction, communication, and by restricted and repetitive behaviors.

Multifinality

The principle in developmental psychology that similar early experiences can lead to different outcomes in individuals.

Equifinality

A principle from systems theory suggesting that different actions in a given context can lead to the same outcome.

Dyslexia

Unusual difficulty with reading; thought to be the result of some neurological underdevelopment.

Q27: Provisions are only recorded if it is

Q39: The cost of land does not include<br>A)costs

Q40: Sun Inc.factors $2,000,000 of its accounts receivables

Q42: The estimated premium liability at December 31,

Q56: Research and development costs that result in

Q68: Oats Company offers a trade discount to

Q74: In an exchange with commercial substance, Huang

Q80: Which of the following is true?<br>A)Rents occur

Q113: On September 1, Hydra purchased $9,500 of

Q118: Which of the following costs should be