Use the following information to answer questions

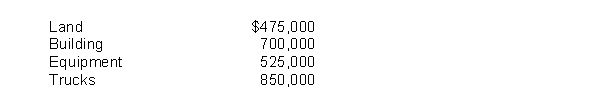

Jamison Company purchased the assets of Booker Company at an auction for $1,400,000.An independent appraisal of the fair value of the assets is listed below:

-On December 1, Miser Corporation exchanged 2,000 shares of its $25 par value ordinary shares held in treasury for a parcel of land to be held for a future plant site.The treasury shares were acquired by Miser at a cost of $40 per share, and on the exchange date the ordinary shares of Miser had a fair value of $50 per share.Miser received $6,000 for selling scrap when an existing building on the property was removed from the site.Based on these facts, the land should be capitalized at

Definitions:

Q12: Unrealized gains from revaluations do not increase

Q17: The effective interest on a 12-month, zero-interest-bearing

Q33: The period of time during which interest

Q39: Collier borrowed $175,000 on October 1 and

Q51: Feine Co.accepted delivery of merchandise which it

Q59: The weighted-average accumulated expenditures on the construction

Q64: Stevenson Company purchased a depreciable asset for

Q66: Which of the following should not be

Q76: What is the effect of freight-in on

Q77: Which of the following is true regarding