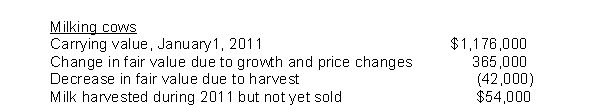

Dub Dairy produces milk to sell to local and national ice cream producers.Dub Dairy began operations on January 1, 2011 by purchasing 840 milk cows for $1,176,000.The company controller had the following information available at year end relating to the cows:  On Dub Dairy's income statement for the year ending December 31, 2011, what amount of unrealized gain on biological assets will be reported?

On Dub Dairy's income statement for the year ending December 31, 2011, what amount of unrealized gain on biological assets will be reported?

Definitions:

Strain Studies

Research efforts that focus on understanding the biological and psychological effects of stress on organisms.

Inbreeding

The breeding of closely related individuals, which can increase the risk of inheriting genetic defects.

Breeding Animals

Breeding animals involves the selective mating of animals to produce specific, desired traits in their offspring.

Adopting Children

The act or process of becoming the legal parent of a child that is not one's biological offspring, providing that child with the rights and privileges of one's own child.

Q17: When a plant asset is acquired by

Q28: During the current fiscal year, Jeremiah Corp.signed

Q33: Cash equivalents are investments with original maturities

Q34: Which of the following should not be

Q46: The cost of the building that should

Q77: Which of the following is true regarding

Q86: Anna has $60,000 to invest.She requires $100,000

Q95: Goren Corporation had the following amounts, all

Q107: The unknown present value is always a

Q123: Research and development costs are recorded as