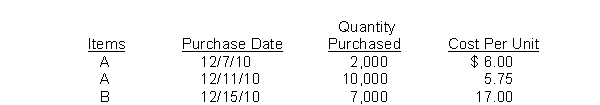

Wise Company adopted the dollar-value LIFO method on January 1, 2010, at which time its inventory consisted of 6,000 units of Item A @ $5.00 each and 3,000 units of Item B @ $16.00 each.The inventory at December 31, 2010 consisted of 12,000 units of Item A and 7,000 units of Item B.The most recent actual purchases related to these items were as follows:  Using the double-extension method, what is the price index for 2010 that should be computed by Wise Company?

Using the double-extension method, what is the price index for 2010 that should be computed by Wise Company?

Definitions:

Natural Resources

Raw materials and substances occurring in nature that can be used for economic gain, such as minerals, forests, water, and fertile land.

Protecting Environment

Activities and practices aimed at preserving natural resources and reducing pollution and waste to safeguard the planet's ecosystems.

Probate Process

The legal procedure through which a deceased person's will is validated, and their estate is distributed to heirs and beneficiaries.

Property Transfer

The act of transferring ownership of property from one party to another, including real estate, vehicles, or other assets.

Q11: The earnings per share computation is not

Q14: Under IFRS, companies may offset assets and

Q24: Certificates of deposit are usually classified as

Q24: Chess Top uses the periodic inventory system.For

Q29: What were the weighted-average accumulated expenditures for

Q34: The International Accounting Standards Board requires the

Q68: Companies should assign no portion of fixed

Q91: The accounts receivable turnover ratio is computed

Q94: Numerous errors may exist even though the

Q118: Barber Company will receive $500,000 in 7