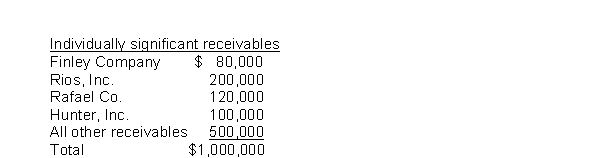

Rosalie Corporation is located in Los Angeles but does business throughout Europe.The company builds and sells equipment used in manufacturing pharmaceuticals.On December 31, 2011, Rosalie's accounts receivable are as follows:  Rosalie Corporation determines that Finley Company's receivable is impaired by $40,000 and Hunter, Inc.'s receivable is totally impaired.The other receivables from Rafael and Rios are not considered impaired.Rosalie determines that a composite rate of 2% is appropriate to measure impairment on all other receivables.What is the total impairment of receivables for Rosalie Corporation for 2011?

Rosalie Corporation determines that Finley Company's receivable is impaired by $40,000 and Hunter, Inc.'s receivable is totally impaired.The other receivables from Rafael and Rios are not considered impaired.Rosalie determines that a composite rate of 2% is appropriate to measure impairment on all other receivables.What is the total impairment of receivables for Rosalie Corporation for 2011?

Definitions:

Debt to Total Assets

A financial ratio that shows the proportion of a company's assets that are financed through debt.

Basic Earnings per Share

A measure of a company's profitability, calculated by dividing net income by the number of outstanding common shares.

Industry Averages

Statistical measures that represent the typical value or norm within a particular industry, used for benchmarking and comparative analysis.

Horizontal Analysis

Horizontal analysis, also known as trend analysis, is a financial analysis technique that compares historical financial data over a series of periods to identify trends, increases, or decreases in financial performance.

Q42: Morgan Manufacturing Company has the following account

Q47: In the International Accounting Standards Board's (IASB's)

Q50: The following information is available for October

Q50: Under International Financial Reporting Standards (IFRS) the

Q57: An adjusting entry to record an accrued

Q83: Treasury shares should be reported as a(n)<br>A)current

Q88: Working capital is<br>A)capital which has been reinvested

Q100: Robertson Corporation acquired two inventory items at

Q101: Confectioners, a chain of candy stores, purchases

Q104: The failure to properly record an adjusting