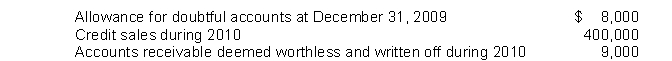

The following information is available for Murphy Company:  As a result of a review and aging of accounts receivable in early January 2011, however, it has been determined that an allowance for doubtful accounts of $5,500 is needed at December 31, 2010.What amount should Murphy record as "bad debt expense" for the year ended December 31, 2010?

As a result of a review and aging of accounts receivable in early January 2011, however, it has been determined that an allowance for doubtful accounts of $5,500 is needed at December 31, 2010.What amount should Murphy record as "bad debt expense" for the year ended December 31, 2010?

Definitions:

Investment Account

An account held at a financial institution that contains securities, cash, and other assets held for investment purposes.

Investment Accounting Method

A set of principles for recording investments on the financial statements, depending on the level of control or influence over the invested entity.

Consolidated Figures

Financial data that combines information from separate entities into a single set of statements, used for overall analysis.

Q4: Hite Co.was formed on January 2, 2010,

Q10: Assets classified as property, plant, and equipment

Q18: The major elements of the income statement

Q28: The future value of an annuity due

Q47: Before year-end adjusting entries, Dunn Company's account

Q56: Freight charges on goods purchased are considered

Q72: Reyes Company had a gross profit of

Q84: Significant accounting policies may not be<br>A)selected on

Q87: Colt Football Co.had a player contract with

Q117: What is the effect of a $50,000