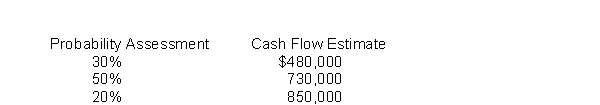

Reegan Company owns a trade name that was purchased in an acquisition of Hamilton Company.The trade name has a book value of $3,500,000, but according to GAAP, it is assessed for impairment on an annual basis.To perform this impairment test, Reegan must estimate the fair value of the trade name.It has developed the following cash flow estimates related to the trade name based on internal information.Each cash flow estimate reflects Reegan's estimate of annual cash flows over the next 7 years.The trade name is assumed to have no residual value after the 7 years.(Assume the cash flows occur at the end of each year.)  Reegan determines that the appropriate discount rate for this estimation is 6%.To the nearest dollar, what is the estimated fair value of the trade name?

Reegan determines that the appropriate discount rate for this estimation is 6%.To the nearest dollar, what is the estimated fair value of the trade name?

Definitions:

National Borders

Geographically defined boundaries that separate the territory of one state from that of another, often established through treaties and recognized in international law.

Turkey

A country located at the crossroads of Europe and Asia, known for its rich history, cultural heritage, and strategic geopolitical position.

Trade Center

A hub or area where commercial transactions and exchanges take place, often involving a concentration of businesses and trade-related infrastructure.

Tay-Sachs Allele

A genetic variant associated with Tay-Sachs disease, a fatal disorder that affects the nervous system and is marked by the accumulation of certain lipids in the brain.

Q9: Kennison Company has cash in bank of

Q14: If a supplier ships goods

Q59: Olmsted Company has the following items: share

Q62: Assume that Henson factors the receivables on

Q66: Assuming no beginning inventory, what can be

Q72: Erin Company applies the same accounting treatment

Q78: Financial information does not demonstrate consistency when<br>A)firms

Q86: The trial balance will not balance when

Q96: Barker Pet supply uses the conventional retail

Q110: Under International Financial Reporting Standards (IFRS) the