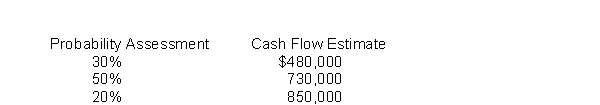

Reegan Company owns a trade name that was purchased in an acquisition of Hamilton Company.The trade name has a book value of $3,500,000, but according to GAAP, it is assessed for impairment on an annual basis.To perform this impairment test, Reegan must estimate the fair value of the trade name.It has developed the following cash flow estimates related to the trade name based on internal information.Each cash flow estimate reflects Reegan's estimate of annual cash flows over the next 7 years.The trade name is assumed to have no residual value after the 7 years.(Assume the cash flows occur at the end of each year.)  Reegan determines that the appropriate discount rate for this estimation is 6%.To the nearest dollar, what is the estimated fair value of the trade name?

Reegan determines that the appropriate discount rate for this estimation is 6%.To the nearest dollar, what is the estimated fair value of the trade name?

Definitions:

Lactose

A disaccharide sugar composed of glucose and galactose, found in milk.

Ductus Arteriosus

Fetal vessel connecting the left pulmonary artery with the descending aorta.

Pulmonary Trunk

Large, elastic artery that carries blood from the right ventricle of the heart to the right and left pulmonary arteries.

Oxytocin

A hormone and neurotransmitter involved in childbirth and lactation, also associated with empathy, trust, sexual activity, and relationship-building behaviors.

Q36: Which of the following organizations is not

Q36: Lenny's Llamas purchased 1,500 llamas on January

Q46: A general description of the depreciation methods

Q47: The current assets section of the statement

Q47: Under International Financial Reporting Standards (IFRS) the

Q68: What amount should be deposited in a

Q87: Which accounting assumption or principle is being

Q97: If both purchases and ending inventory are

Q110: Jeremy Leasing purchases and then leases small

Q115: Which table would show the largest factor