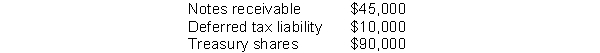

Jarvis, Inc.reported net income of $34,000 for the year ended December 31, 2011.Included in net income was a gain on early extinguishment of debt of $60,000 related to bonds payable with a book value of $1,200,000.Each of the following accounts increased during 2011:

What is the amount of cash used by financing activities for Jarvis, Inc.for the year ended December 31, 2011?

Definitions:

TPOX 8,8 Repeat

Refers to a specific pattern or sequence within the genetic marker TPOX often used in DNA analysis, particularly in forensic science, indicating an 8,8 allele repeat.

D16S539 15,15 Repeat

A specific sequence repetition within the D16S539 locus, a part of DNA used in forensic analysis and genetic fingerprinting.

TPOX 9,11 Repeat

A specific genetic marker characterized by a tandem repeat variation in the TPOX gene, often used in DNA profiling.

Clayton Act

A U.S. antitrust law aimed at promoting competition among businesses and preventing monopolies, focusing on price discrimination, exclusive dealings, and mergers and acquisitions.

Q13: An example of an inventory accounting policy

Q26: The computation of pension expense includes all

Q29: When work to be done and costs

Q65: Which of the following should be shown

Q69: During 2011, Orton Company earned net income

Q81: The omission of the adjusting entry to

Q81: The revenue recognition principle indicates that revenue

Q83: Minear Company reported net income of $340,000

Q90: In a defined-contribution plan, a formula is

Q106: Declaration of a cash dividend on ordinary