Use the following information for questions.

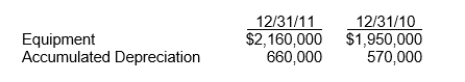

Equipment that cost $300,000 and had a book value of $156,000 was sold for $180,000.Data from the comparative statements of financial position are:

-Depreciation expense for 2011 was

Definitions:

Inventory Costing Method

An approach used to value inventory and determine the cost of goods sold, including methods like FIFO, LIFO, and weighted average.

Cost Flow Assumption

A method used in accounting to determine the value of inventory sold and remaining in stock, common methods include FIFO, LIFO, and weighted average.

Physical Movement

The actual movement or transportation of goods in a supply chain.

Average Cost Flow

An inventory costing method that assigns the average cost of goods available for sale to both ending inventory and cost of goods sold.

Q1: If an IASB standard creates a new

Q18: If a particular transaction is not specifically

Q34: In the International Accounting Standards Board's (IASB's)

Q39: What is a major objective of financial

Q49: The 2<sup>nd<\sup> level of the IASB's conceptual

Q50: Which of the following should be shown

Q54: What is the amount that Cooper Enterprises

Q65: The international financial reporting environment includes challenges

Q75: In computing the service cost component of

Q78: Significant financial reporting issues facing global financial