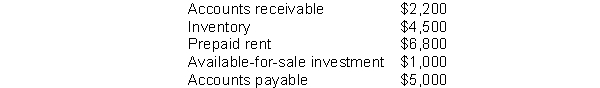

Jarvis, Inc.reported net income of $34,000 for the year ended December 31, 2011 Included in net income were depreciation expense of $8,400 and a gain on sale of equipment of $1,700.Each of the following accounts increased during 2011:

What is the amount of cash provided by operating activities for Jarvis, Inc.for the year ended December 31, 2011?

Definitions:

Proportional Tax

A tax system where the tax rate remains constant regardless of the amount subject to tax, resulting in taxpayers paying the same percentage of their income regardless of the income level.

Higher-income Persons

Individuals or households that have an income significantly above the average for a certain society or area.

Taxes

Mandatory financial charges imposed by a government on individuals, businesses, and transactions to fund public expenditures.

Progressive Tax

A taxation system where the tax rate increases as the taxable amount (income or wealth) increases, aiming to achieve a more equitable distribution of wealth.

Q11: Valuing assets at their liquidation values rather

Q25: Over 115 countries require or permit use

Q26: A segment of a business enterprise is

Q46: When services are delivered by performing more

Q46: Users of financial reports include all of

Q57: Accounting information is considered to be relevant

Q67: The Financial Accounting Standards Board<br>A)has issued a

Q85: An optional step in the accounting cycle

Q97: Major reasons why a company may become

Q104: All of the followings are ways in