Use the following information for questions.

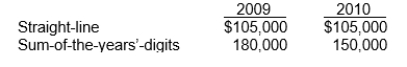

Ventura Corporation purchased machinery on January 1, 2009 for $630,000.The company used the sum-of-the-years'-digits method and no salvage value to depreciate the asset for the first two years of its estimated six-year life.In 2010, Ventura changed to the straight-line depreciation method for this asset.The following facts pertain:

-Ventura is subject to a 40% tax rate.The cumulative effect of this accounting change on beginning retained earnings is

Definitions:

Behavioral Stability

Consistency in patterns of action or behavior over time, reflecting a person's or group's predictability and reliability.

R&D Organization

An organization primarily focused on research and development activities aimed at the creation of new products, services, or processes.

Performance Declined

A situation where the level of effectiveness, productivity, or efficiency of an individual or group decreases compared to a previous period.

Working Together

refers to the collaborative effort of two or more individuals aiming to achieve a common goal by pooling their skills and resources.

Q5: On January 1, 2009, Piper Co., purchased

Q10: The IASB requires that companies classify financial

Q36: The corridor for 2011 is<br>A)$619,200.<br>B)$624,000.<br>C)$678,000.<br>D)$800,400.

Q46: The service period in share option plans

Q47: The interest on the defined benefit obligation

Q49: Which of the following are recognized each

Q59: Under the cost-recovery method, companies recognize revenue

Q73: Which of the following is true with

Q77: All of the following information about each

Q82: When a company amends a pension plan,