Use the following information for questions.

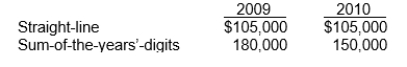

Ventura Corporation purchased machinery on January 1, 2009 for $630,000.The company used the sum-of-the-years'-digits method and no salvage value to depreciate the asset for the first two years of its estimated six-year life.In 2010, Ventura changed to the straight-line depreciation method for this asset.The following facts pertain:

-The amount that Ventura should report for depreciation expense on its 2011 income statement is

Definitions:

Intrinsically Interested

Being intrinsically interested involves engaging in an activity for its own sake, driven by interest and enjoyment, rather than external rewards.

Undesirable Behavior

Actions or conduct deemed inappropriate or harmful by societal or individual standards.

French Exam

A standardized test designed to assess an individual's proficiency in the French language, covering areas such as reading, writing, speaking, and listening.

Marathon

A long-distance running race, officially 42.195 kilometers (26.219 miles), traditionally inspired by the historical run from the Battle of Marathon to Athens.

Q30: The income before income taxes derived by

Q31: The interest cost for 2011 is<br>A)$537,840.<br>B)$607,200.<br>C)$657,360.<br>D)$880,440.

Q36: The basic assumptions of accounting used by

Q36: The corridor for 2011 is<br>A)$619,200.<br>B)$624,000.<br>C)$678,000.<br>D)$800,400.

Q38: At December 31, 2011, Seasons Construction estimates

Q48: According to IAS 1, which of the

Q63: The role of the Securities and Exchange

Q72: Erin Company applies the same accounting treatment

Q73: Presented below is information related to Jensen

Q79: How should the balances of progress billings