Use the following information for questions.

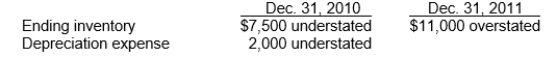

Langley Company's December 31 year-end financial statements contained the following errors:

An insurance premium of $18,000 was prepaid in 2010 covering the years 2010, 2011, and 2012.The prepayment was recorded with a debit to insurance expense.In addition, on December 31, 2011, fully depreciated machinery was sold for $9,500 cash, but the sale was not recorded until 2012.There were no other errors during 2011 or 2012 and no corrections have been made for any of the errors.Ignore income tax considerations.

-What is the total net effect of the errors on the amount of Langley's working capital at December 31, 2011?

Definitions:

Supply Curve

Represents the relationship between the price of a good or service and the quantity of that good or service that a supplier is willing and able to supply to the market.

Willingness To Pay

The maximum amount a consumer is prepared to spend to acquire a good or service, reflecting its perceived value.

Full Cost

The total expense associated with producing a product or providing a service, including both direct and indirect costs.

Consumer Surplus

The difference between the total amount that consumers are willing and able to pay for a good or service and the total amount that they actually do pay.

Q6: Revenue of a segment includes<br>A)only sales to

Q24: In accounting for the intial direct costs

Q31: Fleming Company has the following cumulative taxable

Q32: The IASB has developed IFRS for small-and

Q35: If preference shares are cumulative and no

Q53: Jarvis, Inc.reported net income of $34,000 for

Q59: Financial reports in the early 21st century

Q69: The economic entity assumption<br>A)is inapplicable to unincorporated

Q96: In the International Accounting Standards Board's (IASB's)

Q101: Presently, the IASB and the FASB are