Use the following information for questions.

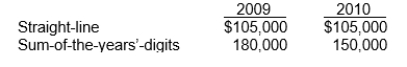

Ventura Corporation purchased machinery on January 1, 2009 for $630,000.The company used the sum-of-the-years'-digits method and no salvage value to depreciate the asset for the first two years of its estimated six-year life.In 2010, Ventura changed to the straight-line depreciation method for this asset.The following facts pertain:

-The amount that Ventura should report for depreciation expense on its 2011 income statement is

Definitions:

1933 Act

Also known as the Securities Act of 1933, a U.S. law enacted to ensure more transparency and honesty in the marketing and sale of securities, aiming to prevent frauds.

Attorney General of the United States

The principal legal officer who represents the United States in legal matters and heads the U.S. Department of Justice.

Dodd-Frank Act of 2010

a comprehensive and complex piece of financial reform legislation passed in 2010 in the United States, aimed at preventing the repeat of the financial crisis of 2008.

Securities and Exchange Commission

A U.S. federal agency responsible for enforcing the federal securities laws and regulating the securities industry, the nation's stock and options exchanges, and other related activities.

Q13: The unexpected gain or loss on plan

Q22: During 2011, equipment was sold for $156,000.The

Q27: The IASB conceptual framework specifically identifies accrual

Q56: On April 1, 2012 Weston, Inc.entered into

Q58: The net cash provided (used) by investing

Q63: In consignment sales, the consignee<br>A)records the merchandise

Q78: Haystack, Inc.manufactures machinery used in the mining

Q84: Brompton Ltd.is evaluating amendments to its pensions

Q90: The International Accounting Standards Board (IASB) defines

Q92: According to the IASB, recognition of a