Use the following information for questions.

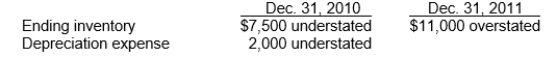

Langley Company's December 31 year-end financial statements contained the following errors:

An insurance premium of $18,000 was prepaid in 2010 covering the years 2010, 2011, and 2012.The prepayment was recorded with a debit to insurance expense.In addition, on December 31, 2011, fully depreciated machinery was sold for $9,500 cash, but the sale was not recorded until 2012.There were no other errors during 2011 or 2012 and no corrections have been made for any of the errors.Ignore income tax considerations.

-What is the total net effect of the errors on Langley's 2011 net income?

Definitions:

Nominal GDP

GDP that has not been adjusted to account for inflation.

GDP Deflator

An economic measure that adjusts the Gross Domestic Product (GDP) by accounting for changes in price levels or inflation.

Gross Domestic Product

The overall economic value of all produced goods and services within the borders of a country, measured over a designated time period.

Output Value

The total value of all goods and services produced by an individual, company, or country.

Q4: For a sales-type lease,<br>A)the sales price includes

Q12: The difference between a financial forecast and

Q12: Amortized cost is the initial recognition amount

Q17: The International Accounting Standards Board's (IASB) rule

Q26: The computation of pension expense includes all

Q29: All of the following statements regarding accounting

Q40: Which of the following is an ingredient

Q45: Both a guaranteed and an unguaranteed residual

Q63: Kraft, Inc.sponsors a defined-benefit pension plan.The following

Q110: In the International Accounting Standards Board's (IASB's)