Use the following information for questions.

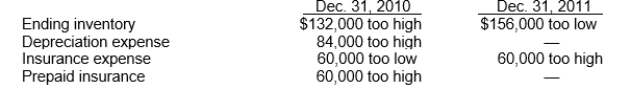

Bishop Co.began operations on January 1, 2010.Financial statements for 2010 and 2011 con- tained the following errors:

In addition, on December 31, 2011 fully depreciated equipment was sold for $28,800, but the sale was not recorded until 2012.No corrections have been made for any of the errors.Ignore income tax considerations.

-The total effect of the errors on Bishop's 2011 net income is

Definitions:

Ability-to-pay Principle

A tax principle that suggests taxes should be levied according to an individual or entity's capacity to pay, reflecting their income or wealth.

Transfer Payments

Payments made by governments to individuals or other entities without the expectation of a direct return or the provision of goods or services, such as social security benefits or subsidies.

Income Distribution

The way in which a nation's total GDP is distributed amongst its population.

Quintiles

Statistical values that divide a set of data into five equal parts, often used in economic and social research to analyze distribution.

Q3: In accounting for a pension plan, any

Q6: Which of the following statements is false?<br>A)Companies

Q14: The IASB has issued many pronouncements in

Q22: Revenue is recognized by the consignor when

Q22: During 2011, equipment was sold for $156,000.The

Q43: At the end of the current period,

Q44: The standards issued by various standard-setting organizations

Q61: International Accounting Standards are no longer considered

Q85: The expectations gap is caused by what

Q93: A common method of measuring the current