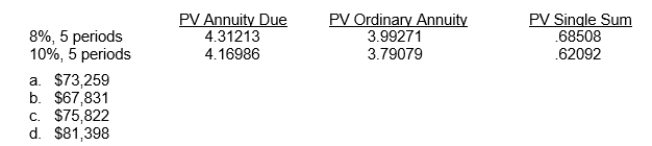

Haystack, Inc.manufactures machinery used in the mining industry.On January 2, 2011 it leased equipment with a cost of $200,000 to Silver Point Co.The 5-year lease calls for a 10% down payment and equal annual payments at the end of each year.The equipment has an expected useful life of 5 years.If the selling price of the equipment is $325,000, and the rate implicit in the lease is 8%, what are the equal annual payments?

Definitions:

Genetic Expression

The process by which information from a gene is used to direct the assembly of a protein molecule, determining physical traits.

Environmental Factors

Elements within the surrounding environment that can affect processes, development, or the condition of something or someone.

Inherited

refers to traits or conditions that are passed from parents to their offspring through genes.

Height

The measurement of someone or something from base to top or from head to foot.

Q3: Recognition of tax benefits in the loss

Q14: Taxable income is a tax accounting term

Q25: Pisa, Inc.leased equipment from Tower Company under

Q40: The purpose of Statements of Financial Accounting

Q57: The IASB<br>A)Has issued over 100 standards related

Q59: Based on this information, which test(s) does

Q60: Companies should recognize the entire increase in

Q69: The employees are the beneficiaries of a

Q70: Morgan Corporation had two issues of securities

Q99: Equipment purchased during 2011 was<br>A)$510,000.<br>B)$300,000.<br>C)$210,000.<br>D)$90,000.