Use the following information for questions.

Alt Corporation enters into an agreement with Yates Rentals Co.on January 1, 2011 for the purpose of leasing a machine to be used in its manufacturing operations.The following data pertain to the agreement:

(a) The term of the noncancelable lease is 3 years with no renewal option.Payments of $155,213 are due on December 31 of each year.

(b) The fair value of the machine on January 1, 2011, is $400,000.The machine has a remaining economic life of 10 years, with no residual value.The machine reverts to the lessor upon the termination of the lease.

(c) Alt depreciates all machinery it owns on a straight-line basis.

(d) Alt's incremental borrowing rate is 10% per year.Alt does not have knowledge of the 8% implicit rate used by Yates.

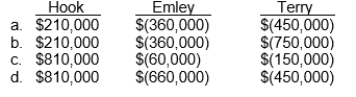

-Hook Company leased equipment to Emley Company on July 1, 2010, for a one-year period expiring June 30, 2011, for $60,000 a month.On July 1, 2011, Hook leased this piece of equipment to Terry Company for a three-year period expiring June 30, 2014, for $75,000 a month.The original cost of the equipment was $4,800,000.The equipment, which has been continually on lease since July 1, 2006, is being depreciated on a straight-line basis over an eight-year period with no residual value.Assuming that both the lease to Emley and the lease to Terry are appropriately recorded as operating leases for accounting purposes, what is the amount of income (expense) before income taxes that each would record as a result of the above facts for the year ended December 31, 2011?

Definitions:

Irreversibility

The inability to mentally reverse a sequence of events or logical operations back to the starting point.

Centration

A cognitive limitation in early childhood development, where a child focuses on one aspect of a situation or object, ignoring other relevant aspects.

Conservation

The act of preserving, protecting, or restoring natural environments, artifacts, and cultural heritages from deterioration or destruction.

Animism

Tendency to attribute life to objects that are not alive.

Q8: On October 1, 2012, Menke Co.purchased to

Q26: When share dividends or share splits occur,

Q27: Assume that the actual return on plan

Q28: What did the IASB decide was a

Q32: Under IFRS, the presumption is that equity

Q38: Mayo Corp.has estimated that total depreciation expense

Q51: On January 1, 2011, Ritter Company granted

Q66: Which of the following basic assumptions of

Q79: Which of the following features of preference

Q110: In the International Accounting Standards Board's (IASB's)