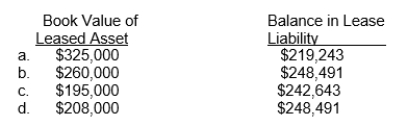

Haystack, Inc.manufactures machinery used in the mining industry.On January 2, 2011 it leased equipment with a cost of $200,000 to Silver Point Co.The 5-year lease calls for a 10% down payment and equal annual payments of $73,259 at the end of each year.The equipment has an expected useful life of 5 years.Silver Point's incremental borrowing rate is 10%, and it depreciates similar equipment using the double-declining balance method.The selling price of the equipment is $325,000, and the rate implicit in the lease is 8%, which is known to Silver Point Co.What is the book value of the leased asset at December 31, 2011, and what is the balance in the Lease Liability account?

Definitions:

Accessible Port

A port that is easily approachable or reachable, facilitating the movement of goods and travelers.

Pacific Ocean

The largest and deepest of Earth's oceanic divisions, extending from the Arctic Ocean in the north to the Southern Ocean in the south.

Spanish-American War

A conflict fought in 1898 between Spain and the United States, resulting from U.S. intervention in the Cuban War of Independence, leading to U.S. acquiring territories in the western Pacific and Latin America.

Battle Casualties

The number of soldiers wounded, killed, captured, or missing in action during a military engagement.

Q4: For a sales-type lease,<br>A)the sales price includes

Q7: Companies should recognize revenue when it is

Q40: The IASB requires that investments meeting the

Q54: All of the following statement are true

Q64: Earned capital consists of contributed capital and

Q67: Safe Skies Travel sells airplane tickets for

Q70: A pension plan is contributory when the

Q76: Qualified pension plans permit deductibility of the

Q102: Application of the full disclosure principle<br>A)is theoretically

Q104: The basic assumptions of accounting used by